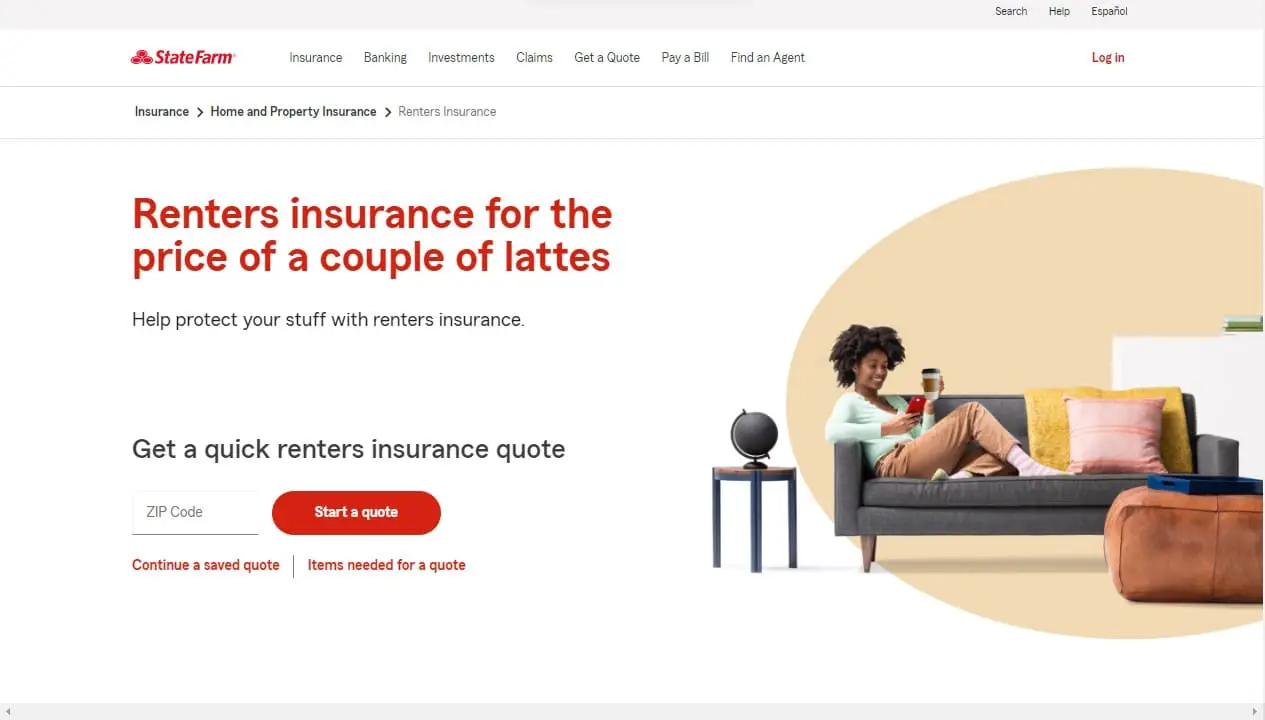

How to Easily Cancel State Farm® Renters Insurance Policy

Are you considering cancelling your State Farm renters insurance policy? Maybe you found a better rate with another provider. Perhaps you’re moving and no longer need coverage. Or you can simply no longer afford the premium payments.

Whatever the reason, cancelling your State Farm renters insurance policy is fairly straightforward. You can cancel over the phone, by mail, or in-person through your State Farm agent.

In this comprehensive guide, we’ll cover everything you need to know about cancelling your State Farm renters insurance, including:

- Understanding State Farm’s cancellation policy

- Step-by-step instructions for cancellation

- Securing new renters insurance coverage

- Avoiding common mistakes

- Notifying other parties

- Impacts to your credit and future insurance

- Key takeaways

Let’s start by getting familiar with State Farm’s cancellation process and policies.

Understanding State Farm’s Cancellation Policy

Before cancelling your State Farm renters insurance, it’s important to understand their cancellation policies to avoid any surprises.

Does State Farm Charge Cancellation Fees?

The good news is that State Farm does not charge cancellation fees on renters insurance policies. You can cancel your State Farm renters insurance at any time without penalty.

However, be aware that if you cancel your policy mid-term, before the end date, you may not receive a full refund on premiums paid. State Farm will prorate your refund based on the percentage of unused coverage.

What is State Farm’s Refund Policy?

If you’ve prepaid policy premiums to State Farm and cancel before the end of your term, you are eligible for a partial, prorated premium refund.

For example, if you paid $600 upfront for an annual State Farm renters policy but cancel halfway through the 6 month term, you will receive roughly $300 back.

Be sure to clarify details on premium refunds when you request the cancellation. Most refunds are issued to the original payment method within 30 days.

Steps to Cancel Your State Farm Renters Insurance

Ready to terminate your renters insurance coverage through State Farm? Here are the simple step-by-step instructions, whichever method you choose:

Cancel by Phone

Calling is the quickest, easiest route for State Farm cancellation:

- Call 1-800-782-8332 to speak with an agent. Let them know you wish to cancel your renters insurance policy when prompted.

- Provide your policy number and personal details. This includes your full name, address, date of birth, etc. to pull up your account.

- Pick a cancellation date. Choose either immediate cancellation or a future date.

- Submit any required proof. Such as a bill of sale if cancelling due to property sale.

- Request written cancellation confirmation. Save this document for your records.

Cancel by Mail

You can also cancel State Farm renters insurance through traditional mail:

- Draft a policy cancellation letter. Include all policy details, reason for cancellation, and your signature.

- Mail letter to headquarters. It must be received at least 2 weeks before your requested cancellation policy end date.

Address: State Farm Insurance Companies

Corporate Headquarters One State Farm Plaza

Bloomington, IL 61710

- Follow up via phone. Contact your agent after mailing to confirm receipt.

Cancel in Person

Lastly, you have the option to cancel by meeting with your agent:

- Contact your local State Farm office. Schedule an in-person cancellation appointment.

- Provide policy documents and ID at appointment. An agent will walk through cancellation details and requirements with you.

- Submit signed cancellation paperwork. Your policy termination will take effect on date of signing.

- Request confirmation receipt. For your personal records.

Avoiding Common Mistakes

While cancelling State Farm renters insurance is straightforward, some key mistakes can complicate things or lead to issues down the road:

Not Giving Enough Advance Notice

Be sure to call or mail your cancellation letter at least 30 days in advance, wherever possible. This prevents getting stuck paying for an additional month.

Lapsing Coverage

Never cancel an active insurance policy without securing new coverage first. Even a single day gap can lead to major consequences.

Misunderstanding Cancellation Refunds

You’ll likely receive a prorated premium refund, not the full unused portion. Clarify details upfront with the agent.

Forgetting to Return Policy Documents

Any remaining digital or physical copies of cancelled policies must be discarded to avoid billing errors.

By being aware of these common cancellation pitfalls, you can avoid unnecessary headaches.

Securing New Renters Insurance Coverage

Another vital consideration when terminating State Farm renters insurance is replacing your coverage through a new provider. Let’s review some key tips:

Shop New Renters Insurance Policies in Advance

Ideally, have quotes from other insurance companies ready to go before calling State Farm. This ensures you can seamlessly transition policies without lapsing important protection.

Compare Types and Pricing Thoroughly

Look beyond the premium price tag alone. Also evaluate policy features, exclusions, deductibles, and company ratings when selecting the right new renters insurance.

Initiate New Policy Before Old One Ends

To prevent a gap here, sign new documentation with your next renters insurance agency at least 1-2 days before your State Farm termination goes into effect.

Avoid Driving Uninsured

While renters insurance is not legally required, protection gaps can spell financial disaster if something happens in the interim period when switching providers.

Notifying Other Parties of Cancellation

Beyond State Farm, you may need to inform other parties when you cancel your renters insurance policy:

Rental Property Owner or Landlord

Check your lease paperwork to see if submitting proof of active renters insurance is required. Keep them looped in on any coverage changes.

Auto Bill Pay or Payment Services

If automatically paying renters insurance premiums through another bill pay service, be sure to halt those scheduled payments after cancellation.

When cancelling State Farm renters insurance, communication is critical for a smooth transition.

What If I Can No Longer Afford My Premiums?

For many policyholders, the top reason for cancelling State Farm renters insurance is no longer being able to pay increasingly expensive premiums.

If you’re struggling to afford coverage, consider these options before outright cancellation:

Contact State Farm Immediately

Inform your agent about financial hardship right away. See if they can offer any premium reductions or discounts to help lower costs.

Ask About Extended Grace Periods

See if State Farm would allow you a little leeway on when payments are due without cancelling outright. This temporary arrangement gives you time to get back on track financially.

Inquire on Late Fee Waivers

State Farm may agree to waive late payment penalties during documentation grace periods to avoid policy cancellation. Doesn’t hurt to ask!

Explore Payment Plan Arrangements

Perhaps splitting the same annual premium amount into more manageable monthly installments could work. State Farm may offer personalized payment solutions.

The takeaway? Be proactive with your State Farm agent when facing financial struggles. There may be an alternative solution to permanent renters insurance cancellation.

Will Cancellation Impact My Credit or Future Insurance?

A common concern when cancelling State Farm renters insurance is potential negative impacts down the road – especially to your credit report or score if you failed to pay premiums.

Here’s what you should know:

Nonpayment Cancellations Can Hurt Credit

If you stop paying renters insurance premiums and State Farm cancels your active policy as a result, this breach of contract can negatively impact your credit standing.

It May Be Harder to Get Future Insurance

Lapsed coverage with State Farm due to nonpayment cancellations often classifies policyholders as “high risk.” This makes securing replacement renters or auto insurance more difficult and expensive.

Maintaining Continuous Coverage Helps

Mitigate these risks by keeping continuous renters insurance through another company. When no gap between active policies exists, your risk level stays consistent when applying for future coverage.

As long as you take proactive financial steps and secure alternate renters insurance ahead of cancellation, terminating State Farm policies typically won’t influence credit or insurability.

Key Takeaways When Cancelling State Farm Renters Insurance

Canceling an active State Farm renters insurance policy takes some planning, but is manageable if you follow proper protocol.

Here are the key takeaways:

- Three cancellation methods – phone, mail, or in-person

- No cancellation fees

- Prorated premium refunds

- Avoid coverage lapses when transitioning insurance providers

- Give 30 days notice when possible

- Inform tied billing services to stop premium payments

- Explore affordability options before outright cancellation

Knowing what to expect from start to finish makes navigating State Farm renters insurance cancellation much smoother.

Conclusion

We hope this guide gave you clarity on successfully cancelling your State Farm renters insurance policy.

The process is relatively straightforward – simply call your agent directly through the 800 number, send a cancellation letter to headquarters, or visit your local State Farm office.

Just be sure to avoid common cancellation pitfalls like prematurely ending coverage before securing an alternate insurer. This prevents paying out-of-pocket if disaster strikes during any protection gaps.

With the right preparation and follow through, you can terminate State Farm policies with minimal headaches and transition to another great renters insurance provider.

Does this fully detailed walkthrough help explain what to expect when cancelling your State Farm renters insurance? Let us know if you have any other questions!